I went camping in late July 2007 and when I got back in early August, the world had changed. The subprime mortgage bubble had definitively exploded. It took more than a year for the financial world to be fully rocked, but the process was in motion by August 2007.

As I blogged on August 12, 2007:

A trillion here, a trillion there, pretty soon we’re talking about real moneyThis is of course not to claim that the American Housing Bubble was the only cause of the series of unfortunate events. It’s like you asking: “What caused American involvement in WWII?” and me answering: “Pearl Harbor.” And then you say, “What about Hitler?”Now that the long predicted dubious mortgage crash has finally arrived, I keep remembering that going back to the early 1990s, the government has been twisting the arms of private lenders to get them to lend more mortgage money to minorities than the private firms believed was justified by colorblind principles of creditworthiness.

This history seems to have disappeared down the memory hole because it's all in the sacred cause of fighting discrimination, but I recall it distinctly from when I was daily reader of the Wall Street Journal in the 1990s.

For example, there was a celebrated 1993 study by the Boston Fed showing that minorities' mortgage applications were rejected at a higher rate. (Peter Brimelow pointed out in Forbes that minorities did not have lower default rates, suggesting that lenders were behaving in a rationally colorblind manner, but that was not a popular view at the time.

Have the chickens finally come home to roost?

I’m sure the private financial markets were quite capable of blowing up a big bubble by themselves in the eternal see-saw struggle between greed and fear, but this political pressure for lending to minorities with doubtful credit must have exacerbated the problem. About half of all mortgages for blacks and Hispanics are subprime, versus about one-sixth for whites. [More]

“Pearl Harbor” is not a complete answer to that question, but it’s a good start. And indeed America took Pearl Harbor very seriously and subsequently invested massively in early warning systems to not be vulnerable to another Pearl Harbor. In contrast, the role of America’s sacred cow of diversity worship in the Housing Bubble has largely been swept under the rug.

Since then, lots of academic studies have shown the massive role played in this by increased minority lending in first driving up home prices during the Housing Bubble and then by high minority default rates during the Housing Bust.

Later, however, I came up with a more refined theory of causality. Government pressure didn’t force lenders to lend to people whom they didn’t believe could pay back. Nobody would do that on a massive scale. They’d get out of home lending and go into commercial real estate lending or something else with less diversity oversight. Or they’d stay small and try not to attract government attention by asking federal permission to buy other banks.

Instead, the government pressure and media cheerleading selected out from the home mortgage industry the pessimists about minority mortgage creditworthiness, who no doubt tended to go into other specialties, leaving only the optimists like Angelo Mozilo of Countrywide and Kerry Killinger of Washington Mutual.

Instead, the government pressure and media cheerleading selected out from the home mortgage industry the pessimists about minority mortgage creditworthiness, who no doubt tended to go into other specialties, leaving only the optimists like Angelo Mozilo of Countrywide and Kerry Killinger of Washington Mutual.

For example, WaMu grew into the sixth biggest bank in the country via dozens of mergers that had to get government approval. One of the ways Killinger became a favorite of regulators was by outbidding rival banks in acquisition wars by making bigger minority lending pledges. The government didn’t hold a gun to Killinger’s head to lend money to strawberry pickers, it just discouraged lenders who were more cautious about minority (especially Hispanic) creditworthiness from growing.

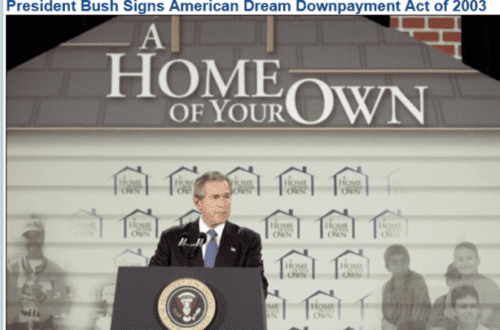

This subtly tipped the playing field in favor of over-optimists. It also turned the mortgage industry into what James Damore would call an “echo chamber” in which dissent from the Bush Administration’s push to increase minority homeownership by 5.5 million households by 2010 by dumping fuddy-duddy and effectively racist standards about down payments and income documentation was restricted to whispers. If you put your doubts in writing in an email, it could turn up in discovery in a discrimination trial.

Yet, writing is a better way to communicate complex ideas than whispering or eye-rolling.